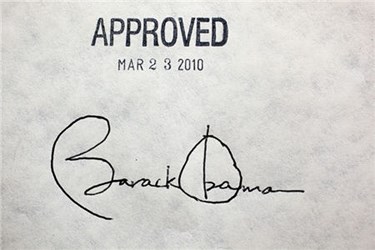

White House Reverses Decision To Cut ACA Cost-Sharing Subsidies

By Christine Kern, contributing writer

Obama administration changes mind on $10 billion in cuts to subsidies

According to The Committee for a Responsible Federal Government, The Office of Management and Budget (OMB) released a report to Congress detailing the sequester’s impact on mandatory spending programs for Fiscal Year (FY) 2015. Significantly, the report demonstrates an important reversal on the fate of the ACA’s cost-sharing subsidies. That program was originally expected to be slashed by 7.3 percent in fiscal 2015 and beyond as part of the sequester cuts, as indicated by the OMB just last year.

The estimated $8 billion in cost-sharing subsidies scheduled to be paid to insurers in FY 2015 will therefore be spared the sequester’s roughly 7 percent haircut, as will the $156 billion projected to be spent over the following nine years.

Modern Healthcare points out that the cost-sharing subsidies get less attention than the tax credits, which are available to individuals making up to 400 percent of the federal poverty level to purchase plans through the state and federal exchanges.

Although not as central to the ACA as the premium subsidies (which are exempt from sequestration because they are structured as tax credits), the subsidies designed to reduce cost-sharing (co-pays, deductibles, out-of-pocket caps) for individuals with incomes between the federal poverty level (FPL) and 250 percent of the FPL are also an important component.

This present reversal on these subsidy cuts, therefore, could be considered a big victory for the ACA, particularly given some complications in how the sequester would be administered. Over the coming ten years, this exemption effectively translates to about $10 billion in restored cost-sharing subsidies.

It is unclear precisely what changed OMB's opinion, but the Committee for a Responsible Federal Budget, a nonpartisan fiscal watchdog group, has suggested that it may be due to the fact that the low-income cost-sharing subsidies for Medicare Part D are explicitly exempted from sequestration.

Ultimately, however, this reprieve for cost-sharing subsidies means other mandatory programs will subsequently see a slight increase in their percentage reduction, including two of the three R’s , outlined here by the Kaiser Family Foundation, intended to protect insurers against adverse selection in the health exchanges – risk adjustment and reinsurance payments. The sequester cuts mean that combined, these two programs, which help plans that end up with higher-cost enrollees, are set to be cut by nearly a billion dollars in FY 2015.

Given fears about insurers ending up with sicker enrollees than they were expecting and subsequently increasing premiums going forward, the sequester cuts to reinsurance payments, in particular, may be concerning. The sequester would also reduce funding for grants to help states run their ACA insurance exchanges, by $61 million in FY 2015.